free crypto tax calculator australia

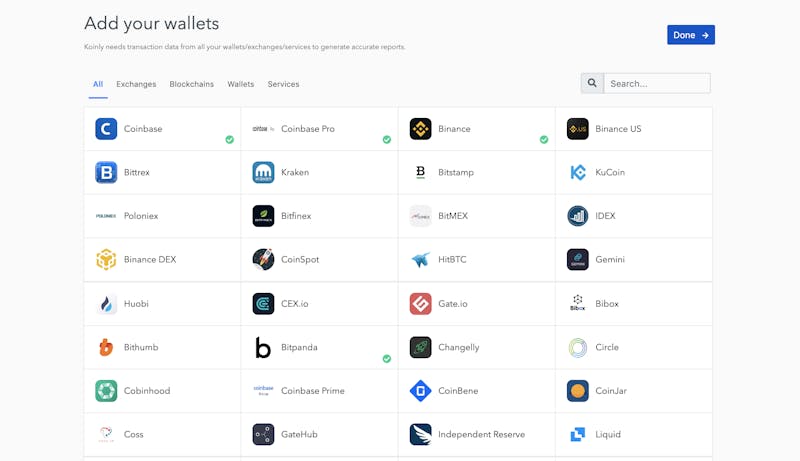

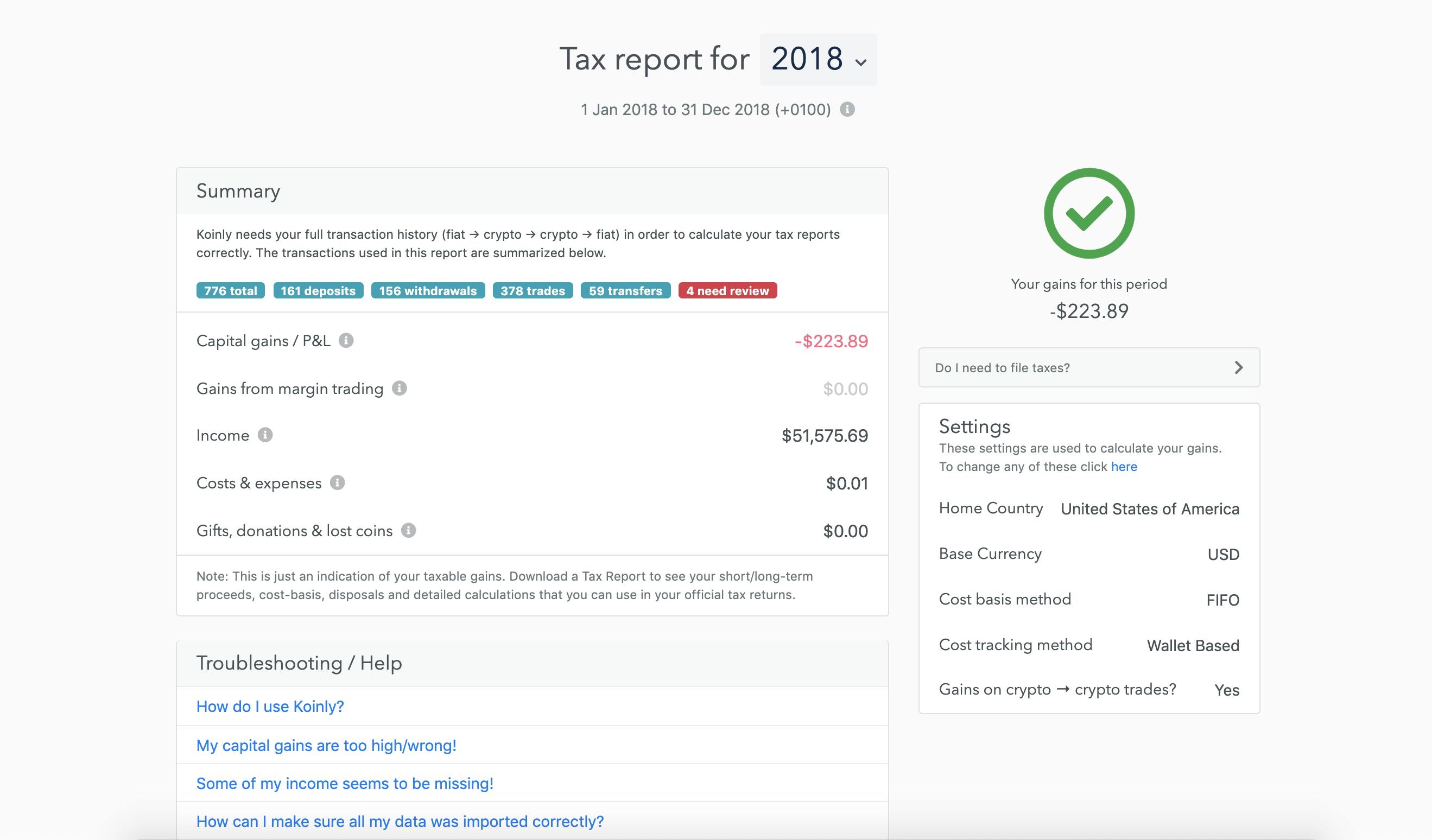

You simply import all your transaction history and export your report. Let Koinly calculate your crypto taxes reduce your ATO tax bill.

Crypto Tax Calculator Australia Calculate Your Crypto Tax

As part of that commitment we are proud to offer all Australian crypto investors an easy solution to filing their taxes.

. Youll only start to pay Income Tax when you hit 18200 in total income per year. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly.

One-click ATO tax form generation. Possibility sector fund QOZF which include 10-year tax-unfastened boom. Capital gains tax report.

It has full integration with popular Australian exchanges wallets to import your crypto. Link trades using FIFO LIFO HCFO or a custom method. Accurate and complex calculations.

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO website and does not. Then sell it for 8000 two months later. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

Selling cryptocurrency for fiat currency eg. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. Australian Taxation Office compliant.

Aggregate Your Exchange Data. Australian Cryptocurrency Record Keeping Made Simple. More markets will be added soon said Kris Marszalek Co.

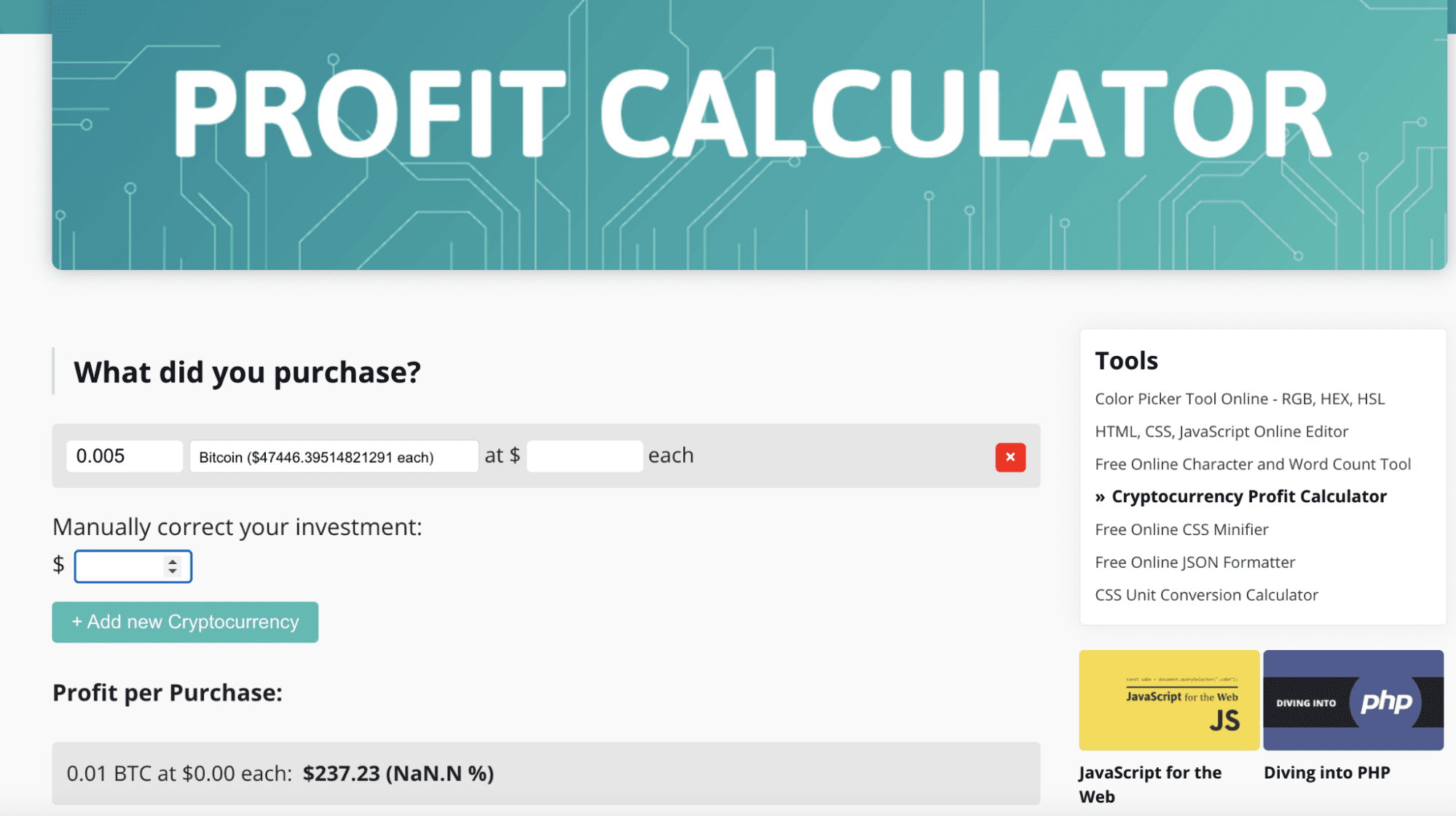

Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting. File your crypto taxes in Australia Learn how to calculate and file your taxes if you live in Australia. We offer a free trial so you can try our service and get comfortable with how it works.

If he were to sell his BTC and cash out he would have to pay taxes on A7000 A12000 A5000 of capital gains. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets. Free Trial Up to 50 Transactions 0 Financial Year.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. Because of the current inflow of crypto traders looking for to diversify. We have long been committed to offering the most compliant and easy to use crypto platform in the world.

You make a capital gain of 5000 on your first transaction. It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses. If you hold your cryptocurrency for more than a year before selling or trading it you may be entitled to a 50 CGT discount.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. Were excited to expand our free-to-use crypto tax reporting service to Australia. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. 50 Capital Gains Tax discount. For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago.

Crypto Tax Calculator for Australia. Ill talk this kind of asset class in my subsequent article. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax.

However our application is valid until the 30th of June each year. May 24 2022. We do not offer final financial year reporting in the free trial.

You would only be subject to pay Capital Gains Tax on 3000 as opposed to 5000. Blox supports the majority of the crypto coins and guides you through your taxation process. You buy another Bitcoin for 10000.

Australian citizens have to report their capital gains from cryptocurrencies. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. Blox free Pro plan costs 50K AUM and covers 100 transactions.

The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard. In many cases this sort of software also includes a complete crypto portfolio tracker and analysis tool to get a bird eye. Crypto Tax Calculator who we recommend for our existing users.

Our crypto tax calculator subscription is per financial year. You can use our crypto tax application to generate as many reports as you wish per financial year along with previous financial years as well as using your personalised dashboard to track your cryptocurrency coins trades and capital gains. Thats a capital loss of 2000 on the second transaction.

1 BTC is now worth A12000. There are cloud-hosting tools specifically designed for crypto miners. The Australian Taxation Office classifies cryptocurrency as an asset.

Australian Dollars triggers capital gains tax. Sign up for free. You can discuss tax scenarios with your accountant.

The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. The free trial is available for 30 days.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

Best Crypto Tax Software Tools For Bitcoin And Altcoin

Bitcoin Price Prediction Today Usd Authentic For 2025

Malta Based Stasis Launches New Euro Backed Stablecoin Euro Bitcoin Bitcoin Price

Koinly Crypto Tax Calculator For Australia Nz

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Free Crypto Tax Calculator 2022 Online Tool Haru

Best Crypto Tax Software Tools For Bitcoin And Altcoin

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Best Cryptocurrency Calculator Mining Profit Taxes

![]()

Cointracking Crypto Tax Calculator