are foreign gifts taxable in the us

Web If you receive a non-cash gift from a foreign person it may be taxable if it is US. There are differences in the foreign gift tax treatment of cash and property.

Form 1120 Schedule N Foreign Operations Of U S Corporations

For example if Michelle receives a 700000 gift from her parents in Spain she does not need to pay a tax on the gift.

. Web Yes foreign gifts are taxable in the US. Web Form 3520 is not a Tax Form There are no specific IRS taxes on gifts received from a foreign person. 5 This value is adjusted annually for inflation.

In general the IRS taxes US persons on their worldwide income. Web This interview will help you determine if the gift you received is taxable. The source of the gift eg.

Web Foreign citizens generally dont have liability for US. Web When a US. Web 1 us tax implications for gifts from foreign citizens.

Web Is there a Foreign Gift Tax. Persons gross income under US. You will not have to pay tax on this though.

Employer opening a bank account This Tool Does Not. Gift tax and therefore dont need to report gifts for those purposes. Person receives a gift from a foreign person.

In other words if a US. Web Gifts to foreign persons are subject to the same rules governing any gift that a US. Because as foreign persons who are not otherwise subject to US tax or US.

Citizens and residents are subject to a maximum gift tax rate of. Web Moreover the United States has no reach over the foreign person who issued the foreign gift. Person receives certain gifts or bequests from foreign corporations those amounts may be considered as part of the US.

Web If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. The IRS requires that you report any gifts you receive from. You must file a gift tax return Form 709 and pay any applicable gift tax.

Lets review the basics of foreign gift tax in the us. Web The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021. Citizens and residents who receive gifts or bequests from covered expatriates under irc 877a may be subject to tax under irc section 2801 which imposes a transfer tax on us.

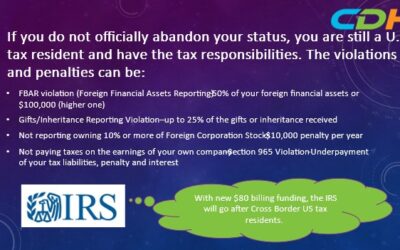

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than. Gift tax rules for citizens residents and nonresidents. Web US Tax implications for Gifts from Foreign Citizens.

The united states internal revenue service says that a gift is any transfer to. Web What are the US. The United States Internal Revenue Service.

Domiciliaries are subject to transfer taxes on their worldwide. Citizen or resident makes. Web If you receive a non-cash gift from a foreign person it may be taxable if it is US.

However separate IRS regulations require recipients to. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520. Web A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the givers life.

Citizens and residents are subject to a maximum rate of 40 with exemption of 5 million indexed for. From a baseline perspective a gift is not income. Generally the answer is No.

Gift tax will apply differently in accordance with whether the donor is a US.

Us Tax Guide For Foreign Nationals Gw Carter Ltd

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Reporting A Gift From A Foreign Source Taxcpe

Annual Gift Tax Exclusions First Republic Bank

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block

Foreigners Can Avoid U S Gift Tax With Proper Planning Meg International Counsel Pc

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

International Trust Estate Planning Loeb Loeb Llp

Tax Forms Irs Tax Forms Bankrate Com

Foreign Clients Take Care When Making Gifts This Holiday Season Insights Events Bilzin Sumberg

Foreign Gift Reporting Requirements Henry Horne

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person

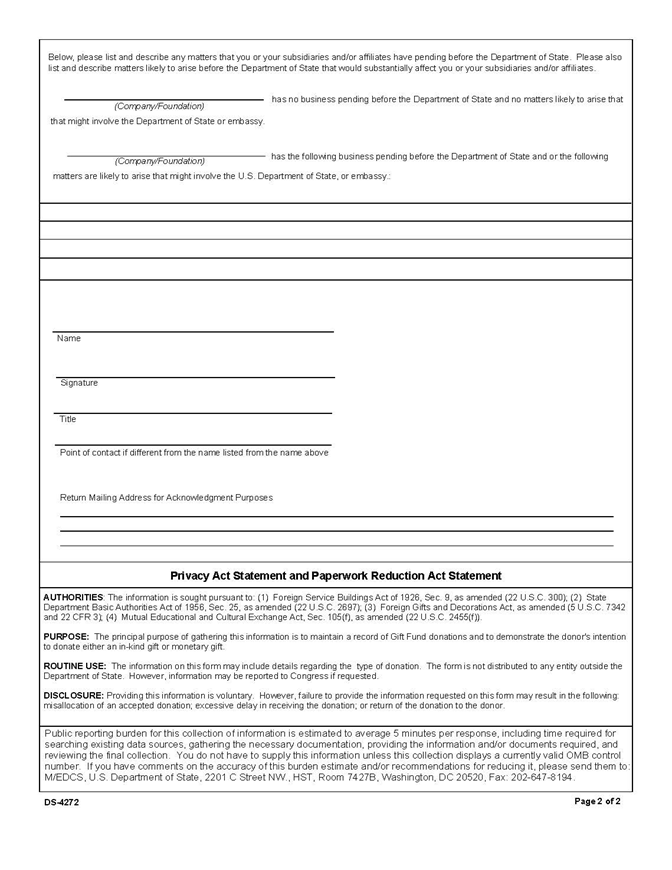

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

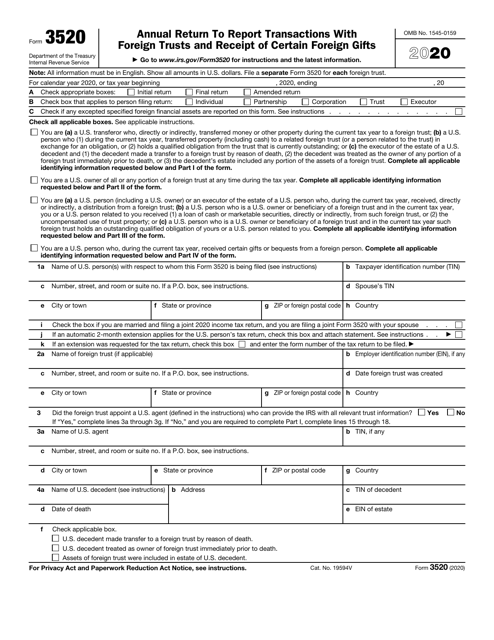

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

Foreign Gift Taxes What You Need To Report

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Irs Form 3520 Download Fillable Pdf Or Fill Online Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts 2020 Templateroller